Next-Gen Finance Platforms

The finance sector is going digital. We deliver secure platforms for transactions, lending, analytics, and more.

Create custom wallets, P2P transfers, UPI/Bharat QR, card tokenization, and payment gateway integration.

Build loan origination portals with customer onboarding, KYC, credit scoring, and EMI calculators.

Deliver secure dashboards for portfolio tracking, investment comparisons, financial education, and goal planning.

Why Choose Cherry Tech

• 10+ years in building fintech apps for B2B and B2C markets

• Certified experts in payment gateway, PCI-DSS compliance, UPI, and digital wallet solutions

• Experience with regulatory compliance (RBI, GDPR, PSD2)

• Built-in KYC, AML, user verification, and fraud prevention layers

• Custom dashboards for investors, banks, and NBFCs

• Proven success in building lending, insurance, crypto, and wealth tech platforms

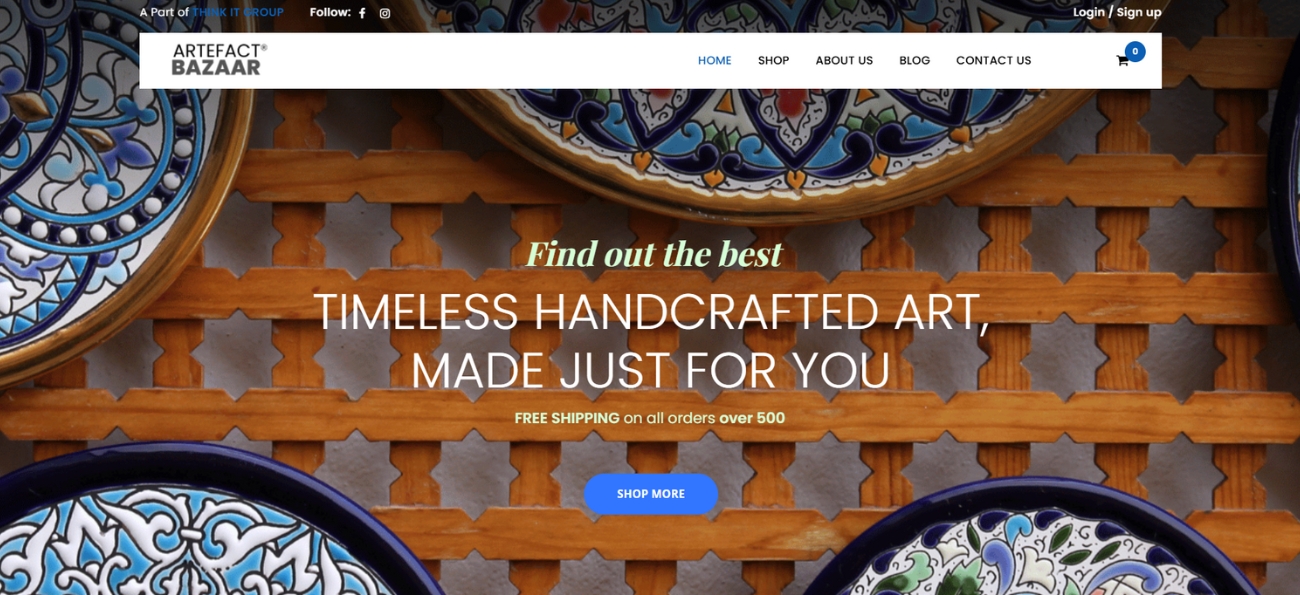

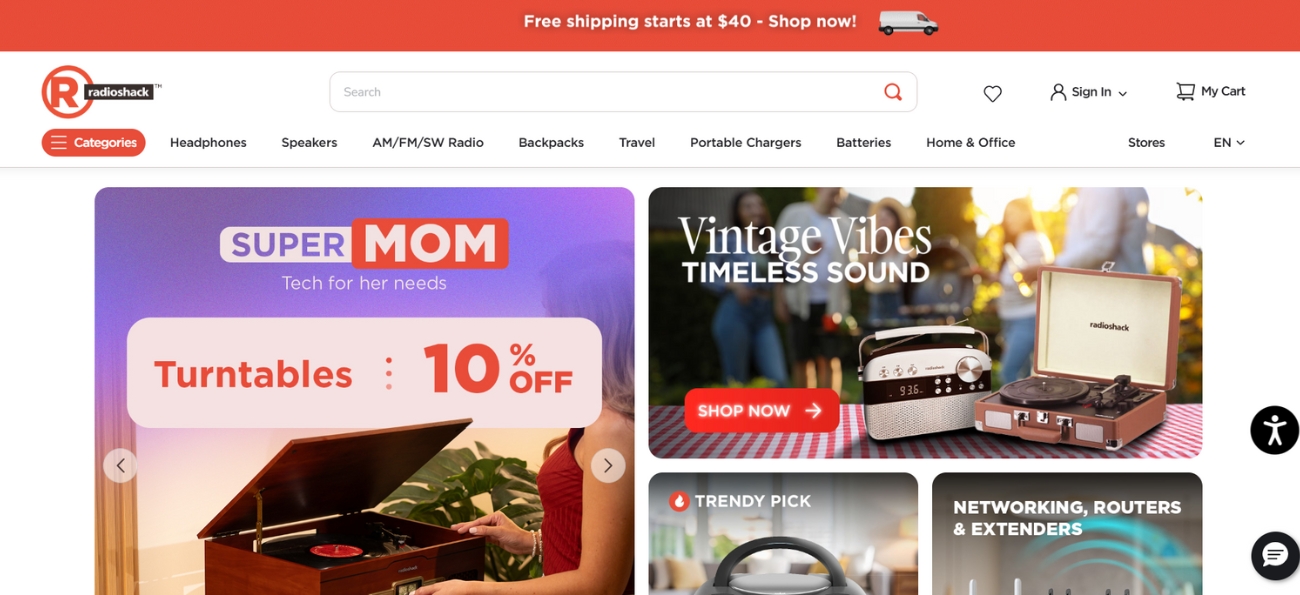

Recent Projects

Our Fintech Development Process

We follow a secure and compliant agile approach to launch scalable, regulation-ready fintech products.

Regulatory Analysis & Features

Define compliance needs (RBI, PCI, GDPR) & plan user flows.

UI/UX for Finance Platforms

Design clean, user-trust-focused UX for finance users.

API, KYC & Payment Integration

Integrate APIs for payments, onboarding, and finance workflows.

Security & Pen Testing

Test transaction flow, encryption, and roles.

Beta Launch & Compliance Signoff

Launch to test groups, gather feedback, finalize compliance.

Reporting & Maintenance

Deliver analytics, uptime, and bug support.

Frequently asked questions

Can you build a UPI or wallet system?

Yes — we have built custom wallets, UPI integrations, P2P transfers, and card storage tools. We follow PCI-DSS and RBI guidelines to create highly secure and user-friendly wallets that work across devices. We also enable integrations with Razorpay, Stripe, and BharatQR.

Do you handle KYC and AML compliance?

Yes — we support KYC integrations (Aadhaar, PAN, Digilocker), AML checks, IP whitelisting, facial verification, and OTP-based login flows. Compliance is a core part of our fintech design workflow.

Can you integrate with banks or NBFCs?

Yes — we’ve worked with banks, credit agencies, and NBFC APIs to create lending portals, personal finance tools, and payment integrations. Full loan management workflows are available.